FTC Sues holder of Online dating services program fit for Using Fake absolutely love curiosity Ads To fool owners into purchasing a complement Subscription

By G5global on Sunday, October 31st, 2021 in tucson eros escort. No Comments

Match cluster, Inc. in addition unfairly subjected buyers on the risk of fraudulence and involved with other presumably misleading and unjust techniques

Show This Site

- Facebook Or Myspace

- Linked-In

Government employees business charge prosecuted dating online provider fit collection, Inc. (fit), the owner of Match.com, Tinder, OKCupid, PlentyOfFish, also dating sites, alleging that the providers put bogus enjoy curiosity campaigns to deceive thousands of consumers into getting settled subscribers on Match.com.

The organization likewise alleges that complement keeps unfairly revealed consumers on the danger of deception and focused on some other allegedly deceitful and unfair procedures. As an instance, the FTC alleges complement offered untrue offers  of “guarantees,” failed to offer solutions to people just who unsuccessfully debated expenses, and made it tough for people to deactivate their unique subscribers.

of “guarantees,” failed to offer solutions to people just who unsuccessfully debated expenses, and made it tough for people to deactivate their unique subscribers.

“We feel that Match.com swindled individuals into paying for subscribers via messages the firm acknowledged had been from fraudsters,” explained Andrew Summers, movie director of the FTC’s agency of Consumer policies. “Online online dating services clearly shouldn’t be employing relationship con artists with the intention to fatten their bottom line.”

Match Touts Dodgy Adore Interests Campaigns, Commonly From Fraudsters

Accommodate allows users to provide Match.com users at no cost, but forbids customers from answering and adjusting communications without replacing to a paid registration. Based on the FTC’s ailment, Match transferred email messages to nonsubscribers proclaiming that individuals experienced conveyed a desire for that shoppers. Especially, once nonsubscribers with free of cost account acquired wants, faves, email messages, and instantaneous messages on Match.com, in addition, they was given emailed adverts from fit motivating these to sign up to Match.com to enjoy the personality belonging to the transmitter and so the information found in the correspondence.

The FTC alleges that many associates that generated Match’s “You trapped his eye” letters originated from records the corporate have currently flagged as likely to be fake. By contrast, Match avoided provide clients from receiving e-mail communications from a suspected fake profile.

Numerous users purchased subscriptions since these deceptive advertising, aspiring to see a genuine owner which might-be “the one.” The FTC alleges that rather, these people commonly might have receive a scammer on the other side terminate. Based on the FTC’s gripe, buyers come into exposure to the scammer if they signed before complement done its fraud testimonial techniques. If Match finished the examine system and wiped the account as fraudulent until the customers subscribed, the customer was given a notification which member profile was actually “unavailable.” In either celebration, the customer ended up being kept with a paid agreement to Match.com, through a false ads.

People exactly who assumed getting a Match.com subscription usually were oblivious that up to 25 to 30 percent of Match.com customers exactly who join every day are utilizing Match.com to attempt to perpetrate scams, most notably love scams, phishing systems, fake marketing, and extortion scams. In a number of many months between 2013 and 2016, more than half associated with immediate communications and favorites that owners got originated records that Match recognized as fraudulent, in line with the condition.

Hundreds of thousands of customers subscribed to Match.com after obtaining interactions from phony profiles. According to research by the FTC’s grievance, from June 2016 to might 2018, one example is, Match’s personal evaluation unearthed that customers buy 499,691 subscribers in 24 hours or less of receiving an advertisement touting a fraudulent communication.

Online dating sites companies, including Match.com, often are employed line up and contact possible love trick targets. Criminals build artificial pages, determine trustworthy affairs, right after which trick buyers into giving or loaning them money. Only a year ago, love cons rated number one on FTC’s selection of full mentioned claims to deception. The profit’s Consumer Sentinel gripe data got about 21,000 reviews about romance tricks, and people said dropping a total of $143 million in 2018.

Complement Deceived Owners with Inconspicuous, Tough To Learn Disclosures

The FTC furthermore alleges complement deceptively caused consumers to subscribe to Match.com by offering all of them a cost-free six-month membership if he or she couldn’t “meet a special someone,” without adequately revealing that people must encounter various obligations ahead of the company would respect the guarantee.

Particularly, the FTC alleges Match neglected to disclose acceptably that consumers must:

- Secure and continue maintaining an open public account with a main picture passed by complement within earliest seven days of buy;

- Message five special Match.com clients every month; and

- Use a development webpage to receive the free 6 months via best few days of this first six-month agreement stage.

The FTC alleges customers usually comprise not aware they’d want to follow additional keywords to get the cost-free six months Match promised. As a result, users are typically charged for a six-month subscription to Match.com at the end of the 1st 6 months, in the place of receiving the no-cost six months of provider they forecast.

Unfair Billing Question and Failure to convey Simple Agreement Cancellation Methods

Thanks to Match’s allegedly misleading marketing and advertising, charging, and cancellation methods, consumers frequently disputed costs through their particular finance companies. The condition alleges that fit consequently banned these individuals from opening the services the two purchased.

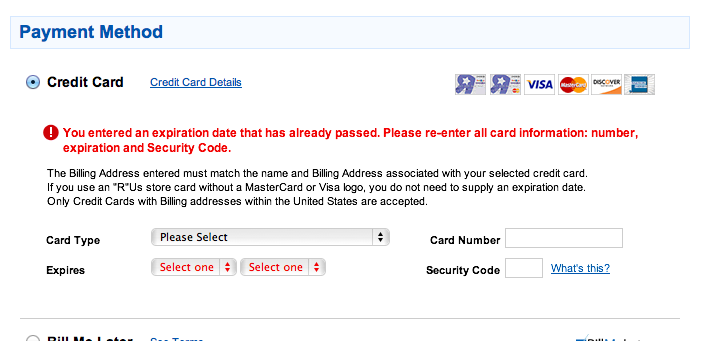

Last but not least, the FTC alleges that accommodate broken the correct using the internet consumers’ poise Act (ROSCA) by failing woefully to give an easy solution for a market to circumvent repeated fees from are positioned on their own visa or mastercard, debit credit, savings account, or other financial account. Each step associated with on the web termination process—from the code admission to the memory provide around the ultimate research pages—confused and disappointed owners and fundamentally avoided lots of customers from canceling their particular Match.com subscriptions, the FTC contends. The ailment claims that Match’s very own staff expressed the termination steps as “hard for, monotonous, and confounding” and took note that “members often believe they’ve terminated whether they have perhaps not and end up making undesirable renewals.”

The fee ballot authorizing the employees to file the gripe would be 4-0-1, with Chairman Joseph Simons recused. The grievance got registered within the U.S. District Court for its north District of Tx.

MENTION: The charge files a problem when it possesses “reason to trust” that the regulation was or is being broken which generally seems to the percentage that a taking the next step is incorporated in the open public attention. The truth will likely be made the decision with the trial.

Leave a Reply