Macy’s Delays Earnings Over $130M in Hidden Expenses by One Employee

By G5global on Monday, September 19th, 2022 in Bookkeeping. No Comments

I am sure if the Accountant wants to change anything, adjusting journals can be done. The example is a bill of $1,000 for General Liability insurance and then two payments of $84. This journal would be used if your business has paid normal balance or will be paying a contractor to repair something. The above journal uses the Other Income account to show it is not part of the normal day to day activity income earned by the business. The amount represents roughly 3% of more than $4.3 billion in delivery expenses during the period, Macy’s said.

Legal Fees Journal Entry

The insurance expense ratio measures an insurance company’s profitability by dividing the expenses of acquiring, underwriting, and servicing premiums by the net premiums earned by the insurance company. The above entry is an adjusting entry and is required at the end of every accounting period. Companies who need accurate monthly financial statements should prepare monthly adjusting entries to make sure that the accounts are up-to-date. The amount paid is charged to expense in a period, reflecting the consumption of the insurance over a period of time. If insurance insurance expense accounting relates to a production operation, such as the property coverage for a factory building, this expense can be included in an overhead cost pool and then allocated to the units produced in each period.

- The amount of money that a policyholder pays will depend on several factors, including the type and amount of coverage they need and the insurance company they choose.

- The journal entry also helps to ensure that the company is properly tracking its expenses.

- In March 2004 the International Accounting Standards Board (Board) issued IFRS 4 Insurance Contracts.

- So, if you originally put the repairs against a Repairs & Maintenance expense account, that is the account you will put the insurance proceeds against.

- The insurance expense ratio measures an insurance company’s profitability by dividing the expenses of acquiring, underwriting, and servicing premiums by the net premiums earned by the insurance company.

- Filing a claim for property-casualty insurance may cause rate hikes in future premiums.

Liam Payne allegedly ordered 9 bottles of whisky and 13 grams of cocaine before his death

The insurance company will then review the claim and decide whether or not it is valid. If the claim is approved, the insurer will issue a payment to cover the cost of the loss or policy event. If the claim is denied, the claimant may need to take further steps to appeal the decision. In either case, it is important to keep detailed records of the claim to ensure that it is being handled properly. Insurance reimbursement is the process of reimbursement to healthcare providers for services provided to the insured. The amount of reimbursement depends on several factors, including Bookstime the type of health insurance policy, the health plan, the healthcare provider, and any previous payments that have been made.

business

The claim is then reviewed for accuracy and any applicable information such as the type of service performed and the cost of the service. The insurance company will then determine the amount of reimbursement for the service based on the type of policy and any applicable co-payments or deductibles. The acquisition of a contractual agreement necessitates a payment to secure coverage for varying types of insurance such as property, liability, and medical. This payment is known as insurance expense and is charged to expenses in a period, reflecting the consumption of the insurance over time.

How is Sales Tax Calculated

The balance in this account will be combined with the balances in other prepaid expense accounts and will be listed on the balance sheet as prepaid expenses. A company’s property insurance, liability insurance, business interruption insurance, etc. often covers a one-year period with the cost (insurance premiums) paid in advance. The one-year period for the insurance rarely coincides with the company’s accounting year. Therefore, the insurance payments will likely involve more than one annual financial statement and many interim financial statements.

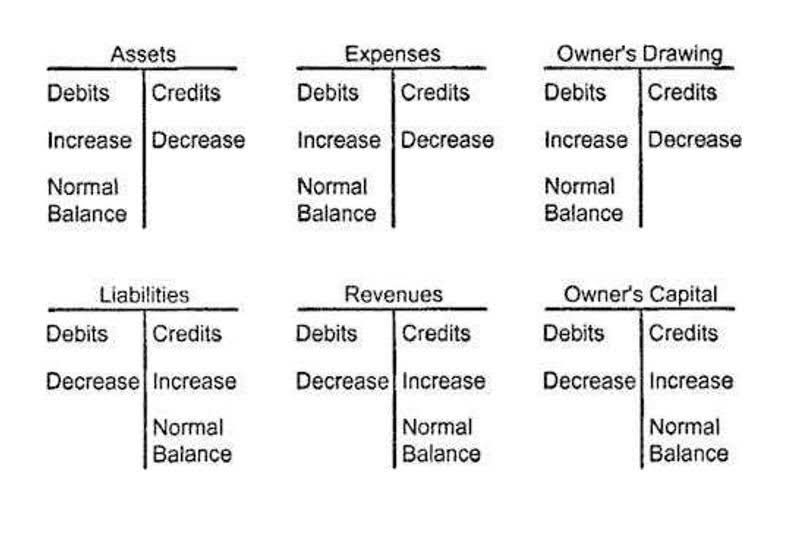

- So when it comes to entering these transactions into the bookkeeping records of a business there are different journal entries to consider.

- Personal insurance payments are not deductible business expenses so must not go on the Income Statement (Profit and Loss Report).

- The insurance expense account will be debited, and the prepaid insurance account will be credited when the asset is charged to expenses.

- On December 1 the company pays the insurance company $12,000 for the insurance premiums covering one year.

Leave a Reply